Today I am going to write about a topic I have never written about before: personal finance. I am writing about this not so much for you, faithful reader, as for my kids. My four- and twelve-year-old girls are probably too young for this discussion, but my eighteen-year-old son, Jonah, is right on the cusp of needing to learn about it.

When I got married in 2000, one of the best gifts given to my bride Rachel and me was lunch with my friend Mark Bauer. Mark and I became friends when we studied at the University of Colorado – he was always my dependable study partner. He is ten years older than me, which at the time meant he had double my maturity (I was twenty-eight).

A few months before our wedding Mark, asked if he could have lunch with Rachel and me. At lunch Mark explained that many marriages come to ruin over money issues.

Mark told us,

A tool that has been very helpful for me is a family budget. On the surface it sounds easy – you project your “revenue” (for your family that would be your and Rachel’s salaries) and then subtract your expenses, and that gives you your net income. If you have money left over then you have savings, and then you can afford to spend money on whatever your hearts desire.

At that point I was a bit disappointed in Mark’s wisdom. I was a few months away from completing the CFA designation, and that was on top of my masters degree in finance. The simplicity of his advice was frankly a little insulting to me.

Mark read my unimpressed facial expressions but continued:

The problem with a normal budget is that though it captures well ongoing daily expenses like a mortgage, the cable bill, groceries etc., it ignores future expenses. Let’s take your car for example. It’s paid for, which is great. But in five years this car will need to be replaced and “suddenly” you’ll discover that you have a onetime $20,000 expense, which should not be sudden and is actually anything but onetime unless you are planning to drive this car for the rest of your life. But the car is just the beginning – you’ll take vacations, buy furniture, your kids will go to college, and then there’s retirement. “

Now this discussion was starting to get more interesting.

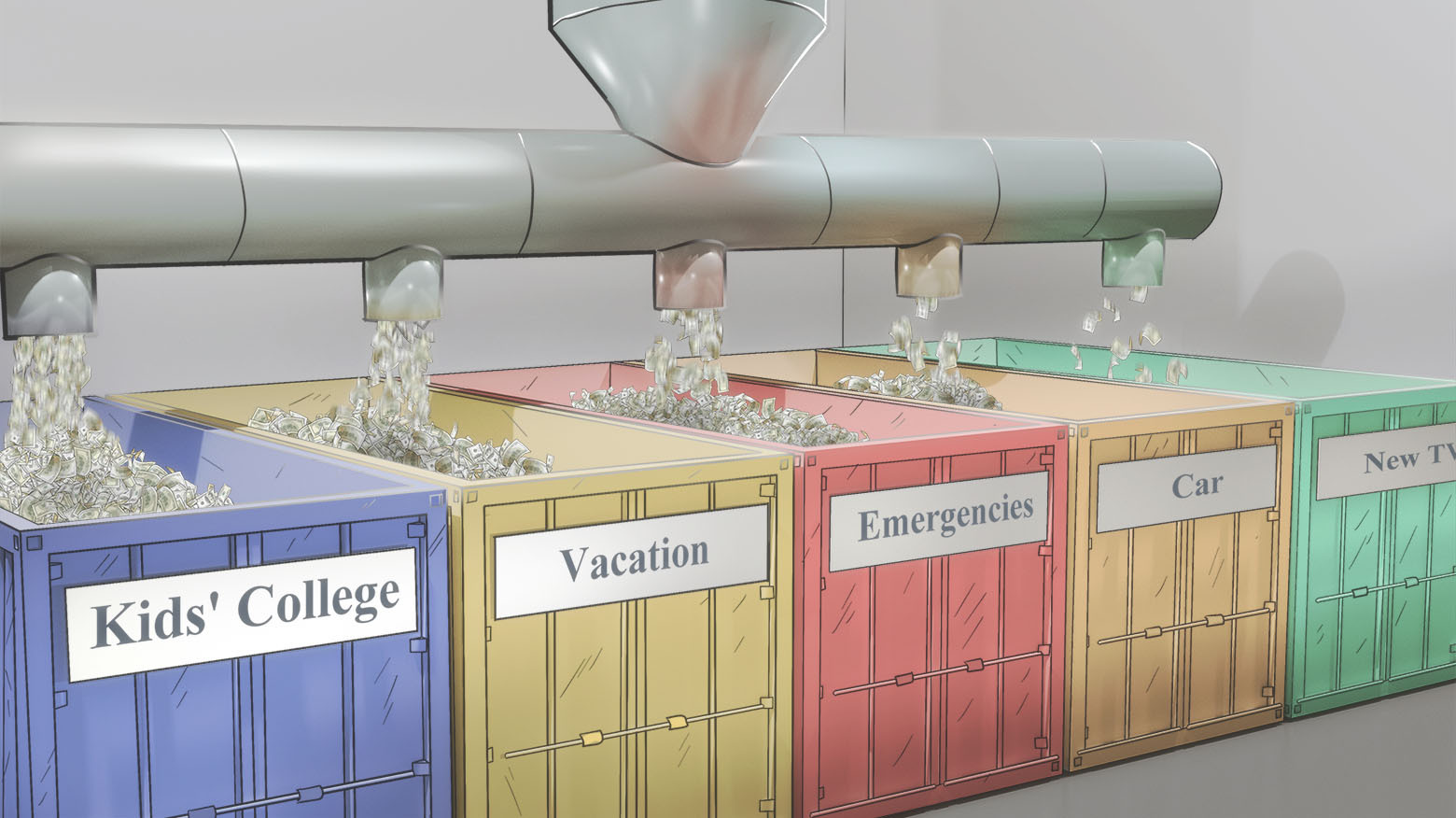

Sit down together and identify all of your expenses, current and future. Once you have identified your future major expenses, create a sinking fund for each one of them.

He explained about sinking funds:

I learned the term from my wife. She used to work for United Airlines. An airline is a very cyclical business, but United knew that they had to repaint their planes every so many years. They set a certain amount of money aside for plane repainting, during both good and bad times. When the time came for a plane to be repainted, they had money in a separate account. It didn’t matter if their business was booming or struggling, the planes got repainted.

Think of “sinking fund” as sink (synch) ronizing the future to the present.

Let’s take your car as an example. If in five years you’ll need to buy a new car for $20,000, you’ll be probably be able to get $5,000 for your present car, and thus you’ll need $15,000. That means you need to save $3,000 a year or $250 a month. This $250 a month should become a line item in your budget, and the $250 should go into a separate account. Or you can use one savings account and track sinking funds on a spreadsheet, but some banks will allow you to create separate savings accounts. You can get fancy and start assuming rates of return, but unless I am dealing with an expense that is at least five years out, I ignore compounding. Take the vaguely right approach rather than the precisely wrong one.

Once you’ve identified your future expenses, create your budget; and I guarantee that you’ll discover that your true income is much lower than you thought. Just because these expenses are going to happen in the future doesn’t make them less real.

What happens to a lot of families that don’t plan for future expenses is they get surprised by them and are forced to borrow. Borrowing makes everything exponentially more expensive, because compounding interest turns from being your friend to your enemy – you start paying interest on interest and the rat race begins.

At this point and I could not wait to go home and fire up Excel and start budgeting. As Rachel and I were guesstimating our monthly and future expenses, we had to make calls to her and my parents. We had both lived with our parents and were oblivious as to how much things cost. Once we figured out how much we’d spend on recurring items like utilities, groceries, car insurance, clothes, etc., we started to think about our future big-item expenses. Suddenly a lot of unexpected things showed up on the list: furniture, car insurance deductibles, a new TV (that was when big TVs cost a lot of money) … and this was all before we had kids.

As I am thinking about this almost two decades later, I see that Mark’s budgeting advice turned our spending from a mindless, often impulsive endeavor into a mindful one. It was a great prioritizing tool. Rachel and I intentionally allocated our limited income to the things that mattered to us the most, at the expense of things that mattered to us less. By bringing all current and eventual expenses into our monthly spending budget, we got rid of unwelcome surprises. Also, when unexpected things happened – a car accident, a significant repair to the house – since money had been saved in the “emergencies” sinking fund and it came out of a different savings (and mental) account, writing a check was a lot less painful.

I realized over the years what Mark saw then: that our wants are unlimited and will always exceed our income. No matter how much money you make, be it $100,000, a million, or ten million, without a system your insatiable wants (if not controlled) will always outpace out your income. You think if you double or triple your income you’ll be happy, you’ll have enough? Unless you keep your expenses the same, which most us of will not do, then you won’t have enough. As we make more money we seem to develop a taste for finer wines, more luxurious cars, and larger houses in pricier neighborhoods.

We’ll always have neighbors and friends who have fancier things than we do. If we allow our internal compass to be magnetized by them, we’re guaranteed a life of misery, as our income will always lag behind our envy and we’ll be destined for the never-ending rat race. Warren Buffett says that envy is the stupidest of all the deadly sins – at least you get some pleasure from the other ones.

As you can imagine, in the investing industry, where you rub shoulders with multi-multi-millionaires and billionaires (be it your clients or colleagues), it is very easy to let your internal compass get out whack. Over the years when our (mainly my) impulses were getting the worst of us, my wife and I would go to the budget and see what we’d have to give up if were to opt for a new car or a bigger house. Was the new house worth a winter without skiing or a Florida vacation?

We realized that material things – houses and cars, etc. – were on the lower end of our priority list. We found that four categories were important to us: health, experiences, time, and education. It’s not that we don’t have a budget for these categories, it’s just the budget is larger and much looser.

Let’s start with health. Without health nothing else matters. A personal trainer may look like an unnecessary luxury, but without him every attempt I have made to work out has failed. (I’ve been working out with a trainer consistently now for over a year). Food fits into this category as well. We simply don’t pay attention to the price of tomatoes or meat at the grocery store.

Education: On top of paying for the education of our kids and their after-school activities, we put no limits on how much money they (and we) spend on books. The same applies to our own education, be it for seminars or coaches.

Experiences: As my kids are growing up I have become acutely aware that we’ll have only a limited time with them. Family vacations, skiing in the winter, and day trips are very important to us. Whenever I travel for business I always try to take a family member with me.

And then there is time. Time is the most finite asset we have. My thinking on this topic has changed over the last five years. I was always bothered when my investment friends used assistants to schedule calls with me or their assistants replied to emails I sent them. I incorrectly perceived that it was their way of telling me that they were more important than others. However, I realized as I got older that money buys time. The time I save by not doing low-value tasks (e.g. going through my inbox, replying to emails that my assistant can respond to, scheduling calls, making doctor’s appointments, or booking airline tickets) I can spend doing research, talking to clients, and yes, hanging out with family and friends.

I am not sure if money can actually bring happiness, but I am sure that the lack of money is a source of a tremendous of unhappiness. On the surface this sentence may fail a test of logic as it lacks linearity, but it’s true just the same. Oxygen doesn’t make you happy, but a lack of oxygen will make you unhappy very quickly. So it is with money. (Although we’ll all disagree on what “a lack” means).

Happiness is reality less expectations. When you control your budget you control your expectations.

When you constantly spend more money than you earn, after you chew through your savings (if you ever had any), then you’re getting deeper into debt. Therefore, to maximize health, education, experiences, and time and still live within our means, Rachel and I had to give up things that were less important to us – a huge house and brand new cars. My wife is driving a 13-year-old car, and I would still be driving the 10-year-old car that I owned for eight years if it hadn’t been stolen. We have lived in the same, not-so-fancy house in a safe but not-fancy neighborhood for 15 years.

I have found over the years that I absolutely hate the feeling of being helpless – a feeling you get when you have no control over life or circumstances. I know that control is an illusion, but I don’t give it up voluntarily.

By living within our budget (and, I am sure, thanks to plenty of good luck), Rachel and I have never had to argue about money (we had plenty of other topics), because we were on the same page, since we both created that budget.

I was lucky to have Mark as a friend who, with just one lunch, made my life richer and easier. I hope that with this article I’ll do the same for others – and Jonah, I hope you’re reading this!

So much wisdom in only a few pages.

I’m told that money is the number one cause of marriage fights. How many could be avoided if Vitaliy’s advice was emphasized!

I love reading your work, Vitaliy. All the best in 2022!

Vitality,

This letter should be given to every high school graduate.

I do not understand why schools don’t have a course called, “You made the money, now let’s spend it smartly”.

Lloyd Forester

FABULOUS! You should bottle this essay and make it REQUIRED READING for every high school graduate (some of whom may not achieve doctoral levels of education). This would solve a multitude of misery in their lives. None of this priceless information is taught in public schools and should be taught as basic life skills. (And thank you for including Mr. Buffett, he surely walks the walk). And thank you John Mauldin for introducing you to us!

28 and still living at home-wow! I left the nest at 17 and never got anything in my life from my dad but shit-certainly never financial support. Nobody ever gave me a penny for tuition/books, rent/food, car/petrol.. All it took was me working 40 hours a week plus carrying a full load at the univ. to hold the draft at bay until I graduated.

But I made it– univ. w/ honors, some law school/graduate school, then drafted in our war of liberation in Vietnam, yet another failure, and ultimately a federal govt job…Obviously you don’t know, but to fire a civil service employee for anything is oh so hard. Be black or female, or both black and female, and your chances of terminating a zero employee are slim to none. Believe me, I tried more than once and l failed.

But on to money-wow, complicated finance spread sheet, particularly when you and Rachel had never paid your own bills, (which I find unbelievable based on my life), so had no clue.

My approach was for the brain dead, being me—just save as much as you can monthly, never buy anything you think is over priced, or what you could create at home for less, and pay cash for everything–well not true. As a retired fed I finally reached a $250,000.00 limit on my United Airlines Mileage Plus card and I was building a 7,000 plus sq ft home in Washington state after I retired in 1995. And I burned the card every month for building materials for my home, (which went south in my divorce.) But, and this is the big but-I paid off the balance monthly and gained over a million air miles with not a penny of interest paid. And to date I have never paid a penny interest on any credit card, but now use them for points to get goodies.

Bottom line-still a millionaire, barely plus. No debt, no mortgage, employ a live in 15 years and counting housekeeper, lawn care, no property tax, no homeowners insurance, 3,500 sq ft home free and clear, and a govt pension that exceeds $100,000 a year which we find impossible to spend living in Chiang Mai, Thailand for the past 20 plus years.

Guess I lucked out learning life lessons from the school of hard knocks from a very early age.

I shall never set foot in America again-I do not like tribalism, “woke”, obese ignorant slobs, anti-vac garbage, Trump, Cruz, et al, being politically correct, a broken political system, and a country with so many living on the streets, so incapable of solving our domestic problems, still wastes billions internationally.

America indeed is an empire in decline and I think is toilet bound—remember “food and circuses” from the Rise and Fall of the Roman Empire, which was the topic of my high school graduation speech which went over like a lead balloon.

Last shot from the Kingdom of Thailand–A needed personal trainer huh? As with all things in my most interesting life, I have learned that will power and self control is generally sufficient to accomplish most goals. Is a personal trainer merely a crutch? I am closing in on 76 years of age and have sinned horribly in my life. It has been a fun ride with few regrets. But, without benefit of a personal trainer, I did HIIT until my aging body could take no more as I turned 75. I was keto adapted for 3 years until I recently lost interest, and still adhere to a time restricted eating regimen with a most healthy controlled diet. And I do it with a small home gym with world class equipment, in my converted air conditioned triple garage since our only quality health club closed 6 years ago.

It doesn’t take a brain surgeon, just will power and desire, and since I generally arise around 4am, my private gym is open when I want it, which is normally around 5:am.

Happy New Year from Thailand.

That is all good sense. Financial matters are one of the two issues that cause most marital breakdowns. (The other is sex.) My wife and I have been together for 49 years, and we have always agreed to live within our means, and to pay immediately for everything except for a mortgage on our home (which we paid off 20 years ago). We have always put savings aside for the next car, and have lived modestly and built savings.

Personal finance should be on the curriculum at all secondary schools. It is far too important to leave for people to learn from their own mistakes.

I did the same thing when first married in the mid 1980s. Good advice as always. Another financial teaching method one can do is start a savings account with each child. Have them keep the pass-book with me as the banker. I gave them 5% each month so they could watch it compound. We had 4 kids so the kids got to watch what happened when one kid would spend some of his and sibling would not. We all did the calculations together on the kitchen table each month. I did limit the account to $200 so it wouldn’t break the bank; me. Cheers!

I liked it, the way it was written. But what if one did not have enough to budget for all items? Also the future is unknowable.