Tesco is a great example of how one should be very careful judging a company’s fundamental performance by looking solely at the performance of its stock.

The company reported another great quarter with a lot of “increases”: total sales increased 4.3%; same stores increased 0.9%; store traffic increased (it has been increasing for many quarters now); employee morale increased; operating margin increased from 1.8% to 2.3%. According to management, Tesco is on track to achieve a 3.5-4% operating margin in 2019-2020. (We think that ultimately Tesco will be able to get to 4.5-5% margins – at its peak in 2009 Tesco commanded a margin of 6.2%). The company’s debt is down from 3.7 billion to 1.9 billion pounds.

Tesco is a showcase of what can happen when you take a great asset and marry it with an awesome management team. Tesco’s current team (headed by Dave Lewis) has done an incredible job returning this grocer closer to its glory days.

Our earnings estimate for 2020 is around 25-31 pence. (At its peak in 2012 Tesco earned 36 pence per share.) At the current price of 174 pence, Tesco is trading at 6-7 times our earnings estimates. (Note that the price you see on your statement is for American Depositary Receipt shares for symbol TSCDY, in US dollars).

It is very easy to look at Tesco and be bored by this stock. It has not gone anywhere for years. Tesco used to be the bluest of the blue chips in the UK – its CEO was even knighted by the queen. Tesco still has a 28% market share in the UK, with sales pushing $80 billion. It is almost double the size of its largest competitor, which gives it significant buying power and lower distribution and overall costs – very important in a retail business. The new management has been returning the company to what it used to be before it lost its way trying to conquer the world and before it was attacked by German discounters Aldi and Lidl.

Tesco’s fundamentals (the performance of its business) and its stock price tell very different stories. As long as the business continues its positive trajectory (which we believe it will), the stock price will start to reflect fundamentals.

The elephant in the room is Amazon. In June Amazon announced its purchase of Whole Foods, and that news sent all retail grocery stocks into a tailspin (Tesco was not spared, either). We’ve been thinking a lot about Amazon and its impact on various industries – even Fedex and UPS: Amazon already owns 40 planes and is experimenting with its own last-mile delivery service, AmazonFlex.

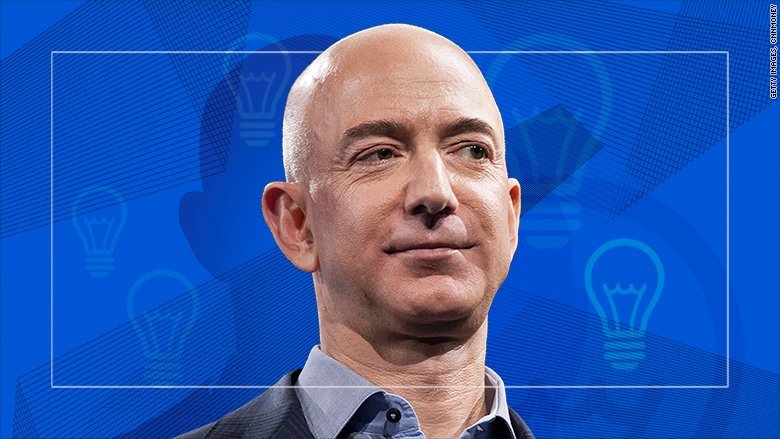

Amazon is an incredible company – we are customers and big fans. However, the market is assuming that Amazon will be able to succeed at anything and everything it tries. Amazon has failed in many of its adventures (mobile phones – remember the Amazon Fire?, WebPay – the PayPal competitor, Amazon Actions – eBay competitor, Amazon Destinations – hotel booking site, etc.). These failures are long gone, but Amazon’s successes are right there in our faces (especially if we are using them every day). Jeff Bezos is willing to try new things, and he is willing to have failures.

We believe Amazon’s success in grocery retailing (even with the help of Whole Foods) is anything but guaranteed. There are many reasons.

Online grocery buying requires a significant change in consumer food preparation habits and therefore shopping habits. Food preparation is done on semi-daily basis, but it is not something that we plan judiciously far ahead. Our in-store grocery shopping is usually done through semi-random browsing through grocery store aisles. Often we stop by the store to buy eggs and end up buying a few dozen items that were not on the initial “buy eggs” list. There is a good reason why Amazon has tried online food shopping for years and has failed (or at least has not succeeded) so far. Online grocery shopping requires thinking and planning ahead and thus is a habit-changing experience for most.

Second, perishable items (especially fruits and vegetables) make the grocery business exponentially more difficult than selling books and TVs. We buy fruits and vegetables on touch. Just take yourself back to your last grocery store visit and recall how many tomatoes or peaches you touched before you bought the perfect ones. We don’t need to touch cereals and soap, but perishables are roughly 30% of grocers’ sales and likely responsible for the majority of visits to the grocery store.

Third, Amazon doesn’t have a significant (if any) cost advantage in grocery retailing. It doesn’t have scale or buying power – it is competing with companies that have enormous buying power in an arena where Amazon has none. (Kroger’s grocery sales are $115 billion, Tesco’s $80 billion, Walmart’s a few hundred billion.)

Amazon drove Circuit City out of business and made Best Buy’s life a living hell because it had a significant structural advantage – but it did not have millions of square feet of expensive real estate (stores), nor did it have salespersons’ expenses.

Amazon’s lack of store footprint was a disadvantage in the grocery business, and Amazon’s purchase of Whole Foods emphasizes the importance of a physical footprint in grocery retailing.

Groceries are a very difficult business with very low margins, where a huge chunk of inventory has a shelf life of a few days. It is going to be very difficult for Amazon to take extra fat out of this business. In the US, Walmart has already been down that road, and Kroger and Safeway went through a few painful years in the early 2000s when they had to become more efficient to compete with Walmart.

In the UK, German discounters forced Tesco and its competitors to cut costs, improve and optimize its product offerings, and become much more efficient companies than they were five years ago. Also, Tesco has 50% market share in the nascent online grocery market in the UK.

Amazon does have one advantage: It doesn’t care about short-term profitability and is willing to lose money for a long period of time. Its focus on the long term at the expense of short-term profitability allowed the company to price CDs and DVDs at or below cost to drive its online competitors out of business. It allowed the company to pour money endlessly into R&D to come up with products like Kindle and Alexa.

Though Amazon’s shareholders will forgive the company if it doesn’t show profits from the grocery business for a while, it has to have a path to profitability in this business. Amazon will not be able to run Wal-Mart, Kroger, or Tesco out of business, and thus its prices are unlikely to be much lower than its competitors’.

Amazon surely will bring new innovation into this space, but it will be zealously copied by its paranoid competitors. Today, everyone is paranoid about Amazon. Everyone! No retailer is dismissing Amazon as a “book seller.” Management, boardrooms, investors, the media – everyone today is scared of Amazon and likely assigns it magic powers that it doesn’t deserve. This paranoia is healthy, as every management team even tangentially impacted by Amazon is devising a game plan to fight Amazon.

In the meantime we are excited about our Tesco position, even if the stock is less exciting than watching paint dry, endlessly.

0 comments