Volatility can be both a feature and a bug of investing. Value investors attempt to treat it as a feature. We try to take advantage of the exuberance of the upswing and the pessimism of the downswing. I use the words attempt and try because though this approach sounds great in theory, reality proves to be a lot more challenging. This gap between theory and practice is created because volatility doesn’t waltz in a vacuum.

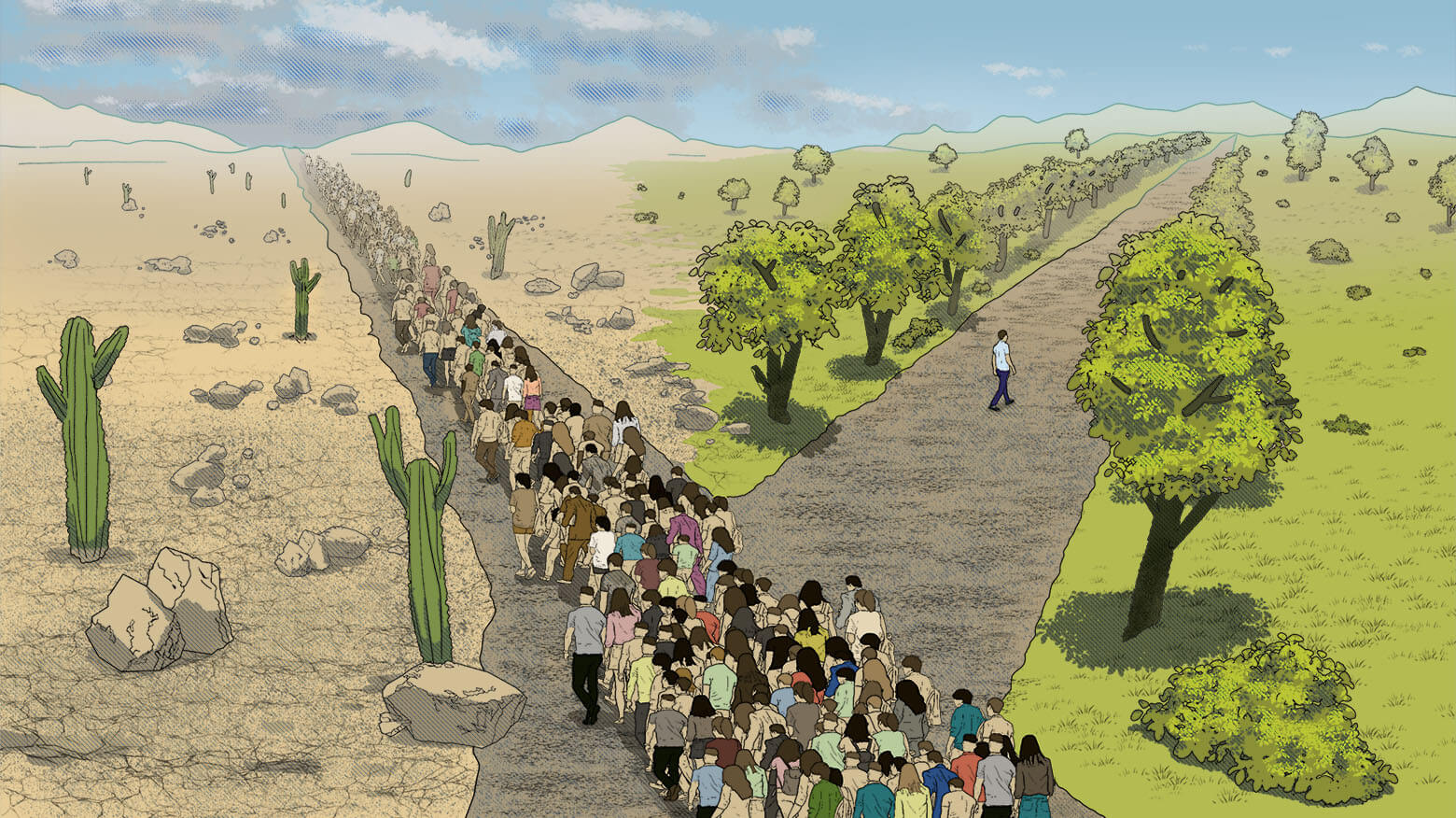

Upswings are accompanied by optimism and positive news , or at least the positive spin the crowd puts on the news – this pushes a stock up. Downswings don’t happen in a vacuum, either; they are accompanied and usually driven by negative news, which results in Mr. Market marking down the value of your initial investment. Fear sets in. What if Mr. Market is right? What if this new news and the army of commentators on CNBC are right?

As the great American philosopher Mike Tyson said, “Everyone has a plan until they get punched in the mouth.” Theory gives you the game plan (buy more when the stock is down), but then the market punches you in the mouth.

Our ultimate goal is to narrow the gap between theory and practice and take advantage of volatility. We do this through thoughtful arrogance.

Let me explain.

Investing is an act of arrogance. You are basically saying, “I am right and the person on the other side of the transaction, who is buying a stock from me or selling it to me, is wrong.” Value investing takes that arrogance to an even greater extreme, as you are often buying unloved, if not hated, stocks.

However, arrogance comes in different forms. Plain vanilla arrogance is very dangerous in investing. Softbank CEO Masayoshi Son built Softbank out of nothing. He is one of the richest people in Japan, he is a visionary, and he has had one of the best multidecade investment track records. (I wrote about him when we bought Softbank a long time ago.)

However, today his Vision Funds are at the tip of the spear of dotcom 2.0 as it shatters against the rock-hard wall of economic reality, losing his investors tens of billions of dollars this year. Mr. Son is solely responsible for it. He recently admitted, “When we were turning out big profits, I become somewhat delirious.” Success went to his head. He started thinking that he had the Midas touch. This is why temperament is so important in investing: We are our own biggest enemy.

And then there is thoughtful arrogance.

This arrogance requires amnesia of your past successes and failures; it is earned with your current sweat, through thorough research. Your research leads you to conclusions that often disagree but sometimes agree with the prevailing trends in the market. Arrogance – belief in your process and research – allows you to follow through on your conclusions, even if the market scorns them.

This is how we try to close the gap between theory and practice created by volatility. We continuously build and update our financial models, talk to companies and their competitors and to industry insiders, do a lot of reading, and debate companies with our peers. We have to keep earning the right to be thoughtfully arrogant through our hard work. When time passes, facts change, and new information comes out, we have to have the flexibility to change our minds. (I did this with Softbank when we sold it a few years ago.)

When you are making thoughtfully arrogant decisions, you are ignoring both what the crowd thinks and, just as important, your past successes. You are arrogant (I am paraphrasing Seneca here) because through your research you have discovered the truth (what the company is worth) before time did.

For example, our Uber investment required a lot of thoughtful arrogance. We endeavor to practice it daily, in every investment decision made.

I plead with you again: Earn thoughtful arrogance through your own sweat and research. It cannot be acquired through reading my articles. I am sharing this with you not to provide you with fish but to teach you how to fish.

Hidden Forces

One last thing. I was interviewed by the brilliant Demetri Kofinas on his Hidden Forces podcast. It is one of the very few podcasts I listen to every week. Along with discussing Soul in the Game, the economy, and the markets, I shared the story of how I got General McChrystal and others to endorse my book. You can listen to the interview here.

0 comments