Stock Analysis

Hedging the Portfolio with Weapons of Mass Destruction

Uber's business is doing extremely well. It has reached escape velocity – the company's expenses have grown at a slow rate while its revenues are growing at 22% a year.

From Twinkies to Rolexes (IMA Client Dinner 2024 Video)

Once a year, we host what the IMA team gently calls “client appreciation week.” This week is very special to me, as I get to meet people who have entrusted their life savings to us.

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio.

My Appearance on John Oliver’s Last Week Tonight (Kind of)

This past Sunday, I received a text from a friend who told me he saw me on John Oliver's "Last Week Tonight" show on HBO.

No Shortcuts to Greatness: The Path to Successful Investing

One of my principles in life is to have a net positive impact on the people I touch. If every single stock I discussed only went straight up, I wouldn't have to worry about it. But this is not how life works.

Investing in a New Era of Global Tensions

You don’t have to worry about the market and its crazy valuations. That’s your neighbor’s problem, not yours. In building your portfolio, we are aiming for resilience.

Why the Survival and Dominance of Car Manufacturers is Far from Certain

Today EV sales account for a tiny rounding error of total global car sales. Can traditional automobile companies successfully transition to making EVs?

Next Year in Omaha (2024 Edition)

It is time to plan for my annual pilgrimage to Omaha! I am very sad because, for the first time, Warren Buffett will not be joined onstage by Charlie Munger, who passed away in November.

Putting a Charge Back into the EV Market

Over the last few months, electric car sales seem to have gone from hot to cold. Are electric cars a fad, like beanie babies, pet rocks, or fidget spinners?

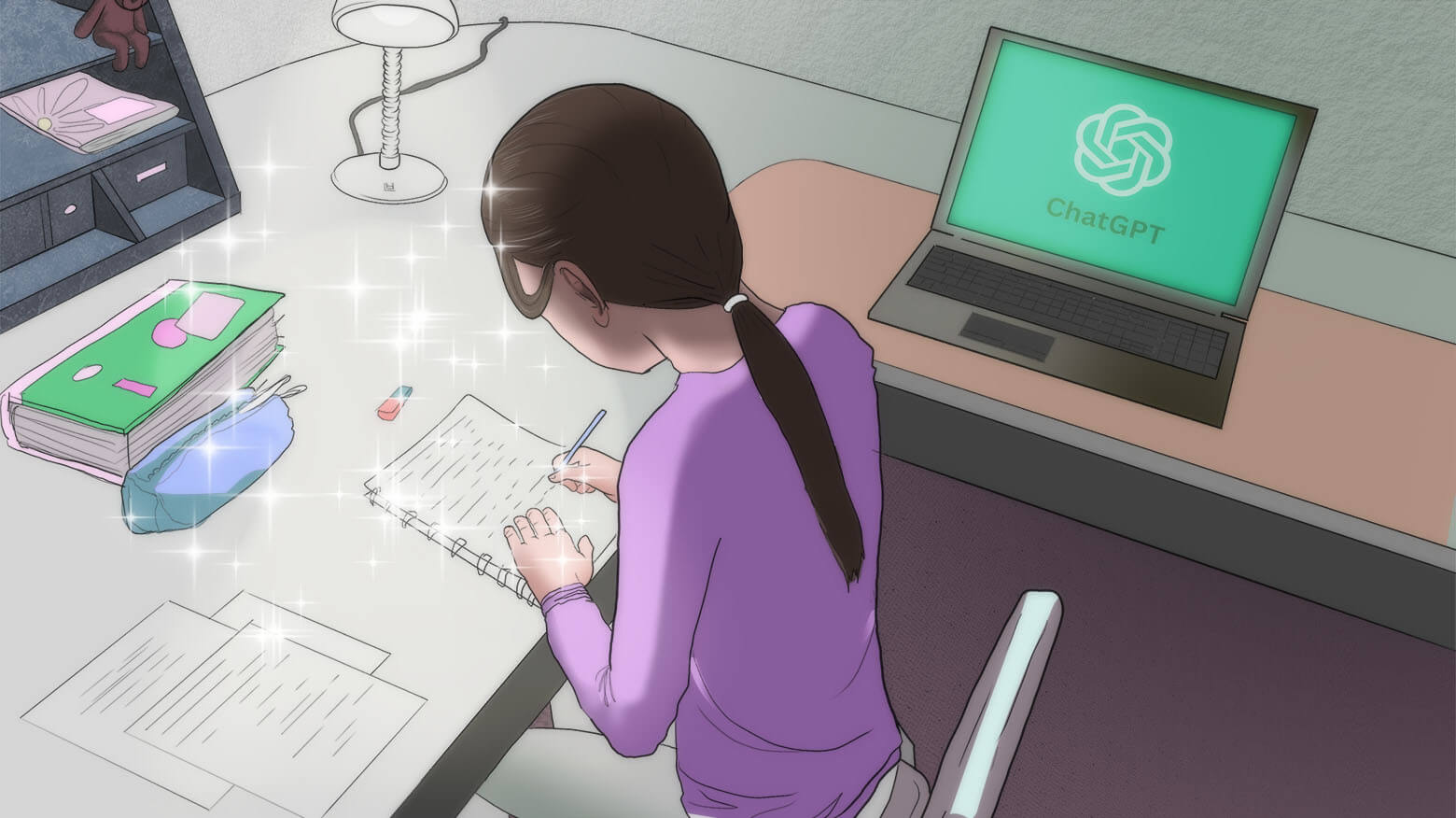

My thoughts on AI

Innovation disrupts, but it also creates new jobs and improves the standard of living of society. AI will displace many jobs, but it will also empower people with new productivity tools.

Tax Loss Harvesting

I wrote the following to clients on tax loss harvesting, which is something many investors are either contemplating or doing ...

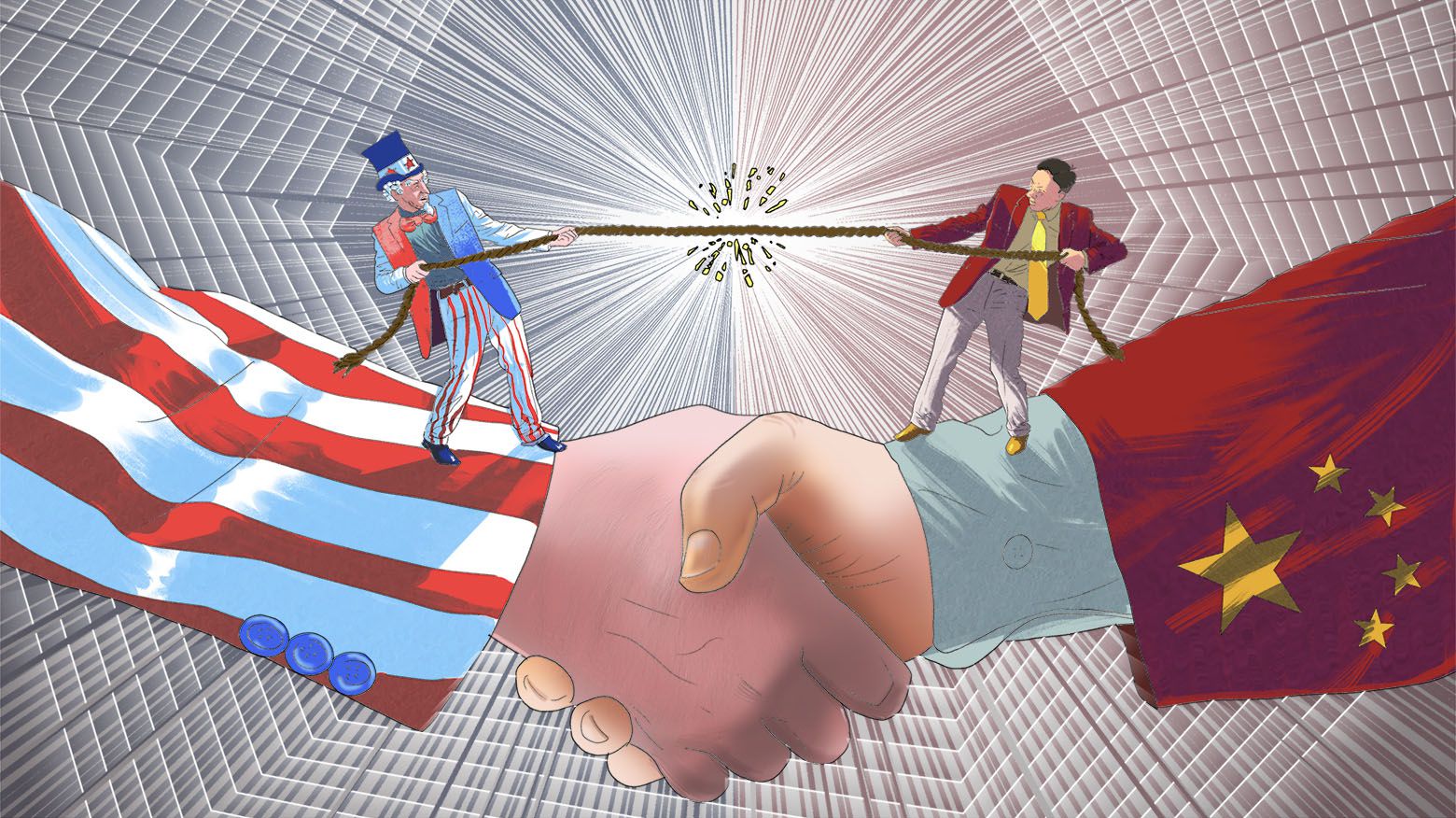

What happens in China may not stay in China

To understand what will happen in China and its impact on the global economy, we simply need to invert what happened over the last two decades.

Our investments in oil and natural gas stocks

I am about to discuss a topic that, for reasons that are unclear to me, has been politicized: oil and natural gas stocks. I am writing this as a pragmatic analyst who looks at two factors: supply and demand.

Unions: From Stimulant for the Economy to Cancer

Unions have had a very important role in shaping the US and our laws over the past hundred years. I have read stories about how working in Chicago meat packing plants a century ago was as hazardous as enduring the trenches in World War I. Unions have fixed that.

My thoughts on the economy

A collection of my thoughts on the economy, government spending, interests rates, housing market, and other important points.

Why I No Longer Mind Losing an Argument

Reflecting on my experience with Dale Carnegie's book, I share how it transformed my approach to criticism and debate, and why I no longer mind losing an argument.

How do I get any research done since I travel a lot?

I get asked at times: How do I get any research done since I travel a lot? To answer this question, I need to explain how we do research.

The Growing Pains of Maturity

Many times, we bought because they were in their “junior year”; this is what made them undervalued. Our research led us to the conclusion that their difficulties were transitory and that as they matured the market would revalue them.

What is the Value of Apple? How do we evaluate risk?

Today I will share the Q&A section of the letter. Every time I am almost finished with the client letter, I ask clients to send me any questions they have about their portfolio or other topics. I answer these questions in the Q&A section.

Vision Pro is the Vision of the Future

I have read reviews of Vision Pro, Apple’s virtual reality headset. Meta’s Quest Pro suddenly started to remind me of Microsoft PCs – made by engineers for engineers, where the Vision Pro is created by humans for humans

A Story about a Story

Apple is the best storytelling company on the planet. In its storytelling, Apple so wants you to fall in love and have an emotional connection with its product that it even names the parts that go into it.