Vitaliy Katsenelson

Stand For Something in Life – Conversations with Vitaliy – Ep 37

I took a stand when I spoke about Israel, here is why I did it. Here are all my articles about Israel: 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the Game - The Little Book of Sideways Markets -...

Dad, You Are Not Growing! (Embracing Vulnerability)

Dad, you are not growing. You’ve stopped learning new things. You used to have new, creative ideas. Lately you were just improving things that are familiar to you.

Hedging The Portfolio With Weapons Of Mass Destruction – Ep 219

Read my full article about AI here: 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the Game - The Little Book of Sideways Markets - Active Value Investing - My Key Links 🌍 My website/blog - ...

Hedging the Portfolio with Weapons of Mass Destruction

Uber's business is doing extremely well. It has reached escape velocity – the company's expenses have grown at a slow rate while its revenues are growing at 22% a year.

Skin in the Game vs Soul in the Game – Conversations with Vitaliy – Ep 36

If you want to learn more about Soul in the Game, you can a copy of my book here: 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the Game - The Little Book of Sideways Markets - Active Value...

Cable Stocks Keep Getting Punched In The Mouth – Ep 218

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio. Read my full article about AI here: 📩 Join 86,000+ readers on...

From Twinkies to Rolexes (IMA Client Dinner 2024 Video)

Once a year, we host what the IMA team gently calls “client appreciation week.” This week is very special to me, as I get to meet people who have entrusted their life savings to us.

The Right Way To Think

If you try to figure out not what they think, but how they think, then you will learn to fish not just get the fish. For a long time, a lot of people wanted to meet with Warren Buffett.

How will AI Change Investing? – Conversations with Vitaliy – Ep 35

AI is changing the way we live our life, and investing is no different. Here is how AI will change investing in my eyes. Read my full article about AI here: 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the...

No Shortcuts To Greatness: The Path To Successful Investing – Ep 217

One of my principles in life is to have a net positive impact on the people I touch. If every single stock I discussed only went straight up, I wouldn't have to worry about it. But this is not how life works. 📩 Join 86,000+ readers on my weekly...

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio.

Construct the Optimal Portfolio – Conversations with Vitaliy – Ep 34

A reader of mine recently asked me how I would construct the optimal portfolio. Here is how I would do it. 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the Game - The Little Book of Sideways...

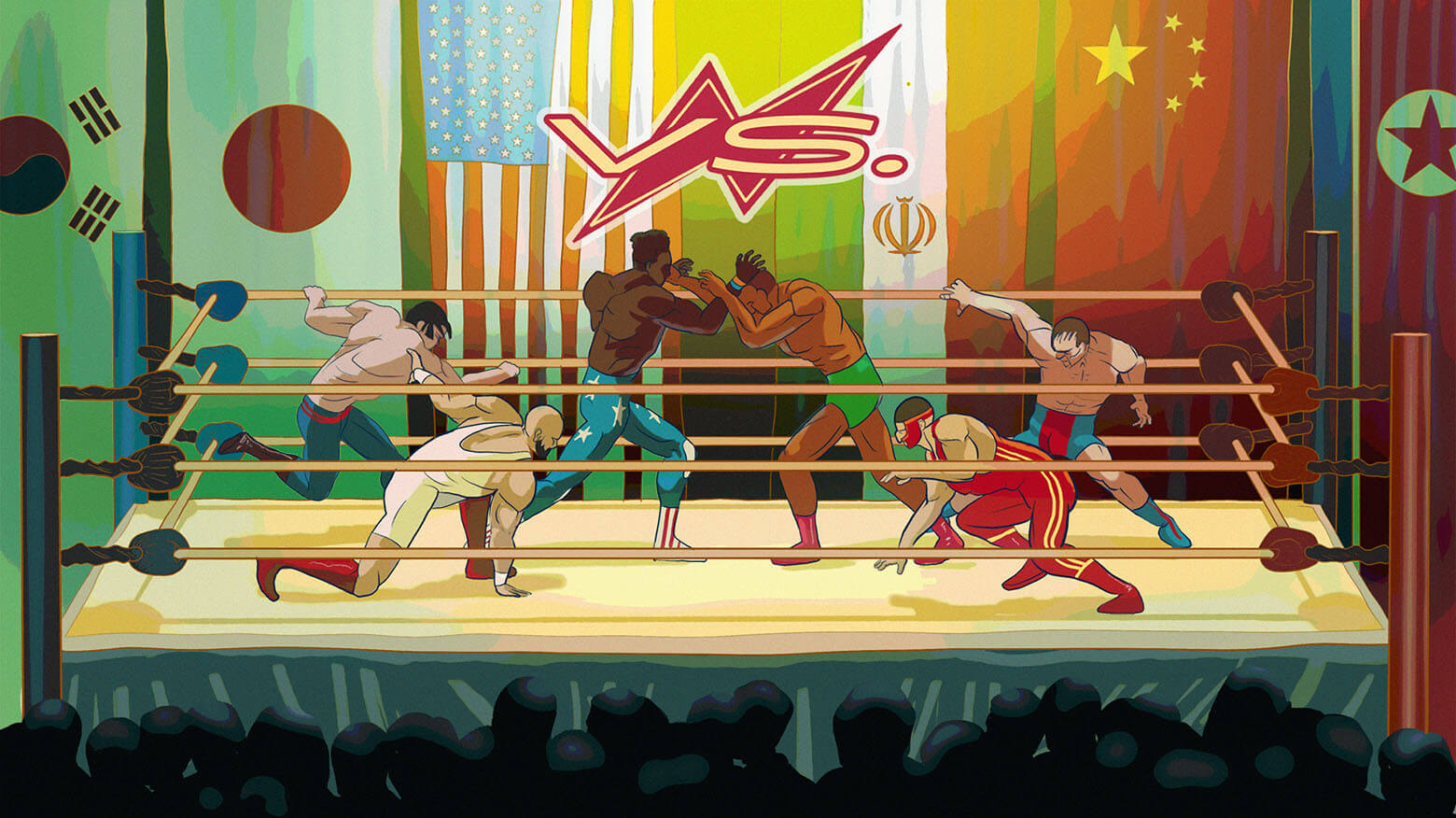

Investing In A New Era Of Global Tensions – Ep 216

You don’t have to worry about the market and its crazy valuations. That’s your neighbor’s problem, not yours. In building your portfolio, we are aiming for resilience. 📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books:...

My Appearance on John Oliver’s Last Week Tonight (Kind of)

This past Sunday, I received a text from a friend who told me he saw me on John Oliver's "Last Week Tonight" show on HBO.

4 Mental Models To Change Your Thinking – Conversations with Vitaliy – Ep 33

Here are 4 Mental Models That Will Change Your Life: 𝗜𝗻𝘃𝗲𝗿𝘀𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 (𝗜𝗻𝘀𝗽𝗶𝗿𝗲𝗱 𝗯𝘆 𝗖𝗵𝗮𝗿𝗹𝗶𝗲 𝗠𝘂𝗻𝗴𝗲𝗿)...

No Shortcuts to Greatness: The Path to Successful Investing

One of my principles in life is to have a net positive impact on the people I touch. If every single stock I discussed only went straight up, I wouldn't have to worry about it. But this is not how life works.

Data Driven Hiring

I love being the CEO of IMA. I get to set the direction of the company, decide on its long-term and short-term goals, and build the IMA culture and team.

Why the Survival and Dominance of Car Manufacturers is Far from Certain – Ep 215

Today EV sales account for a tiny rounding error of total global car sales. Can traditional automobile companies successfully transition to making EVs? 📩 Join 86,000+ readers on my weekly email newsletter: 📚 GET MY BOOKS Soul in the...

Will Your Kids Remember You? – Conversations with Vitaliy – Ep 32

📩 Join 86,000+ readers on my weekly email newsletter: 📚 Get my books: Soul in the Game - The Little Book of Sideways Markets - Active Value Investing - My Key Links 🌍 My website/blog - 🔗 Business Website - 🐦...

Investing in a New Era of Global Tensions

You don’t have to worry about the market and its crazy valuations. That’s your neighbor’s problem, not yours. In building your portfolio, we are aiming for resilience.

Expanding Perspectives Through Travel – From Spain to the UK – Ep 214

My brother Alex, my son Jonah, and I went to a conference in Switzerland. We saw this as an opportunity to turn the bookends of the trip into a small European vacation. 📩 Join 86,000+ readers on my weekly email newsletter: 📚 GET MY BOOKS...