Articles

Hedging the Portfolio with Weapons of Mass Destruction

Uber's business is doing extremely well. It has reached escape velocity – the company's expenses have grown at a slow rate while its revenues are growing at 22% a year.

From Twinkies to Rolexes (IMA Client Dinner 2024 Video)

Once a year, we host what the IMA team gently calls “client appreciation week.” This week is very special to me, as I get to meet people who have entrusted their life savings to us.

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio.

My Appearance on John Oliver’s Last Week Tonight (Kind of)

This past Sunday, I received a text from a friend who told me he saw me on John Oliver's "Last Week Tonight" show on HBO.

No Shortcuts to Greatness: The Path to Successful Investing

One of my principles in life is to have a net positive impact on the people I touch. If every single stock I discussed only went straight up, I wouldn't have to worry about it. But this is not how life works.

Data Driven Hiring

I love being the CEO of IMA. I get to set the direction of the company, decide on its long-term and short-term goals, and build the IMA culture and team.

Investing in a New Era of Global Tensions

You don’t have to worry about the market and its crazy valuations. That’s your neighbor’s problem, not yours. In building your portfolio, we are aiming for resilience.

Why the Survival and Dominance of Car Manufacturers is Far from Certain

Today EV sales account for a tiny rounding error of total global car sales. Can traditional automobile companies successfully transition to making EVs?

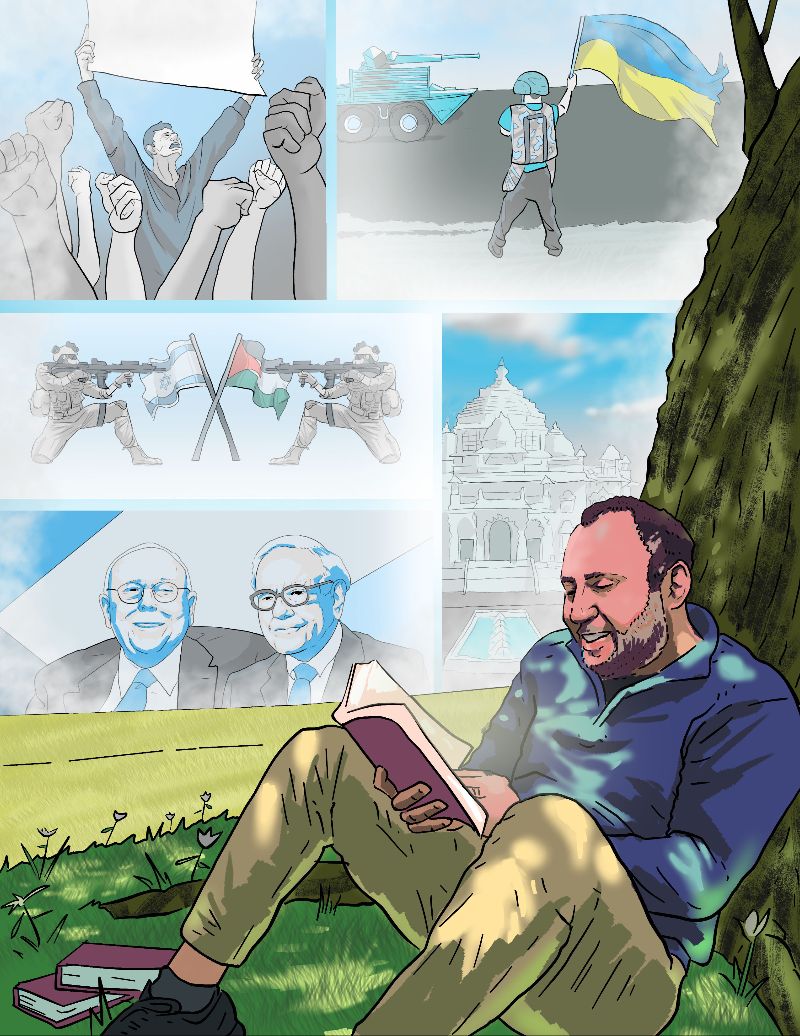

Next Year in Omaha (2024 Edition)

It is time to plan for my annual pilgrimage to Omaha! I am very sad because, for the first time, Warren Buffett will not be joined onstage by Charlie Munger, who passed away in November.

Expanding Perspectives Through Travel – From Spain to the UK

My brother Alex, my son Jonah, and I went to a conference in Switzerland. We saw this as an opportunity to turn the bookends of the trip into a small European vacation.

Putting a Charge Back into the EV Market

Over the last few months, electric car sales seem to have gone from hot to cold. Are electric cars a fad, like beanie babies, pet rocks, or fidget spinners?

Antisemitism and Wokeness Threaten the Future of Israel and America

My goal with this essay on antisemitism and wokeness is to bring an important issue to the surface for those who were oblivious to it and to possibly change the minds of those whose minds are still changeable.

Article Almanac 2023

A few years ago, the IMA team started a new tradition. At the end of the year, we gather all of the essays I had written throughout the year, organize them by topic, sprinkle in some art, nip and tuck them into a single PDF, and voila, we have an almanac.

Broadening the aperture of how you look at life

The interview took place in April 2023 at Temple Sinai here in Denver. The focus of the discussion was on my book Soul in the Game: The Art of a Meaningful Life. The living characters of the book are from my family, so having them in the audience was a bit surreal.

My thoughts on AI

Innovation disrupts, but it also creates new jobs and improves the standard of living of society. AI will displace many jobs, but it will also empower people with new productivity tools.

Tax Loss Harvesting

I wrote the following to clients on tax loss harvesting, which is something many investors are either contemplating or doing ...

Don’t Let History Repeat Itself

I always wondered what I would have done if I were a Jew living in Germany on November 9th, 1938. Kristallnacht, the night when Germans attacked Jews across the country. Would I run? Would I fight? Would it make a difference?

Israel is Not Hamas’ Final Solution

Hamas, with sadistic creativity that made the Nazis look like amateurs, in just a few hours slaughtered 1,500 Jewish civilians. The Nazis tried hard to hide their atrocities. Not Hamas.

What happens in China may not stay in China

To understand what will happen in China and its impact on the global economy, we simply need to invert what happened over the last two decades.

Our investments in oil and natural gas stocks

I am about to discuss a topic that, for reasons that are unclear to me, has been politicized: oil and natural gas stocks. I am writing this as a pragmatic analyst who looks at two factors: supply and demand.

Unions: From Stimulant for the Economy to Cancer

Unions have had a very important role in shaping the US and our laws over the past hundred years. I have read stories about how working in Chicago meat packing plants a century ago was as hazardous as enduring the trenches in World War I. Unions have fixed that.