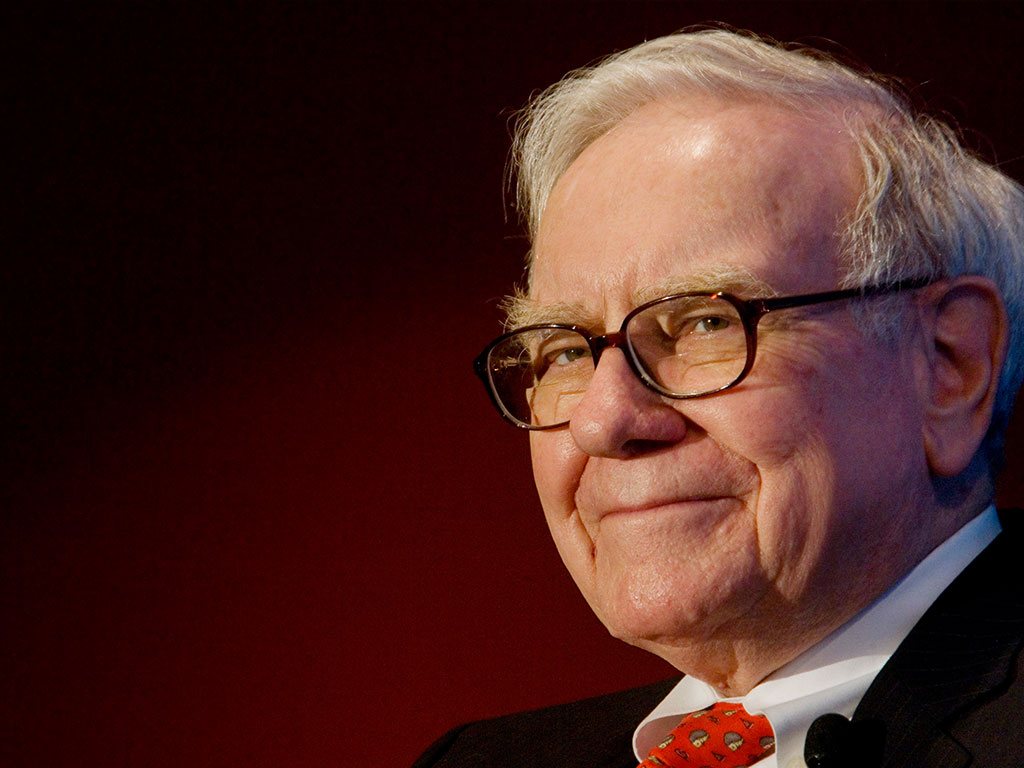

Berkshire Hathaway buying Heinz is unlike any deal Buffett has ever done. In his past deals he was always a passive owner – he let existing management continue to run the company. In this case 3G, a private equity firm that has done terrific turnarounds in the past, will be the new management. They are putting in $1 billion of capital for half of ownership, but also a lot of sweat capital. On the surface Buffett is paying 20 times earnings, a fairly high multiple even for this high-quality business, but 3G involvement will likely elevate the earnings power of Heinz significantly over time. So this is a classic Buffett deal in one respect: Buffett is saying, I’m willing to pay a premium for a quality business that has long-term pricing power. (Heinz scores great on both counts). Buffett is willing to pay a premium for it, but this time the premium is less than it appears on the surface.

Please read the following important disclosure here.

Related Articles

From Twinkies to Rolexes (IMA Client Dinner 2024 Video)

Once a year, we host what the IMA team gently calls “client appreciation week.” This week is very special to me, as I get to meet people who have entrusted their life savings to us.

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio.

My Appearance on John Oliver’s Last Week Tonight (Kind of)

This past Sunday, I received a text from a friend who told me he saw me on John Oliver's "Last Week Tonight" show on HBO.

No Shortcuts to Greatness: The Path to Successful Investing

One of my principles in life is to have a net positive impact on the people I touch. If every single stock I discussed only went straight up, I wouldn't have to worry about it. But this is not how life works.

0 comments