We live in the society where, to our detriment, being politically correct is often more important than being correct. So I am going to come out and make a politically incorrect statement – social investing is an oxymoron.

There is nothing social about investing. Investing is not about making popular, socially approved choices. It is about allocating capital from a less efficient use to more efficient use. Touchy-feely types of choices make us feel good about ourselves… well, until we have to retire and have to start paying for things.

It is hard enough finding good investments, and adding more very subjective criteria to the mix only makes it more difficult. In fact, if you scrutinize any company long enough it won’t pass the “social” test.

- Political donations: A company is giving money to the wrong (another very subjective criteria, unless it is something black-and-white like Al Qaeda) cause or party.

- Treatment of employees (very subjective): Does Wal-Mart (WMT) treat its employees fairly? Do you start looking at employee compensation of every company you invest in? One should only care about how well a company pays its people if it impacts company’s fundamentals.

- Labor practices (for example, use of child labor): Do you avoid companies that use parts made in China or manufactured in China? If you did this in your personal life, you’d be walking around naked as textile manufacturing for the most part has migrated to China and other low wage countries where labor practices may not meet your standards.

- Charge too much – this is a big category, ranging from pharmaceutical companies (companies that save millions of lives a year) to payday loan companies, college loan providers and so on.

- Environmental citizenship – Do you avoid oil companies and refineries? What about auto companies who make gas-guzzling SUVs?

Some companies are trying to capitalize on the social investing idea to make you feel good about their “socially conscious” businesses. British Petroleum changed its name to BP (BP) and advertises on CNBC with a slogan “BP – Beyond Petroleum”.

So you don’t have any illusions about BP, it is only 4% beyond the petroleum. 96% of its sales come from petroleum products. If BP focused instead on running its business, its stock would perform a lot better than “petroleum-behind” Exxon Mobil (XOM).

I probably missed a dozen categories, but you get the idea. When social investing is taken to the extreme it turns into a very taxing exercise and substantially limits the ‘investable’ universe.

Avoiding sin – socially irresponsible – stocks (i.e. defense, tobacco, gambling and alcohol) doesn’t severely limit an investor’s stock universe and is not very taxing on time and effort, as sin stocks are easily identifiable. However, this may prevent you from following attractive opportunities.

In fact, I’d argue that this is the time to own these anti-social sin stocks as demand for their products is not closely tied to economic prosperity (they have a cycle of their own) and they’ll be a place to hide if the economy takes a turn for the worse.

Neither my company nor I own many anti-social stocks. I wish we owned more. We own Diageo (DEO) – the largest spirits maker in the world, that owns brands from Johnnie Walker to Bailey’s. As baby boomers age, they switch to higher grade liquors – higher margins for Diageo.

Also, liquor has got to be one of the most exportable goods after bubble gum. As the developing world develops – yes, you guessed it right – it’ll speak Johnnie Walker’s language. Also, as we get older we tend to drink more hard liquor and less beer – this is main reason why I own Diageo instead of Budweiser (BUD), not because drinking hard liquor is more socially responsible than drinking beer.

Adam Smith’s invisible hand did not wear a social glove and for a good reason: social criterions only add inefficiency to the system of capitalism.

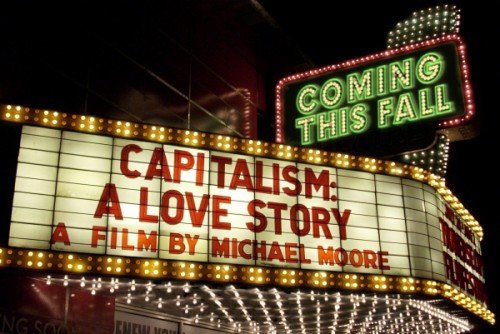

I’d like to conclude by quoting Larry the Liquidator, a character from my favorite movie, “Other People’s Money”:

Take the money. Invest it somewhere else. Maybe, maybe you’ll get lucky and it’ll be used productively. And if it is, you’ll create new jobs and provide a service for the economy and, God forbid, even make a few bucks for yourselves…

0 comments